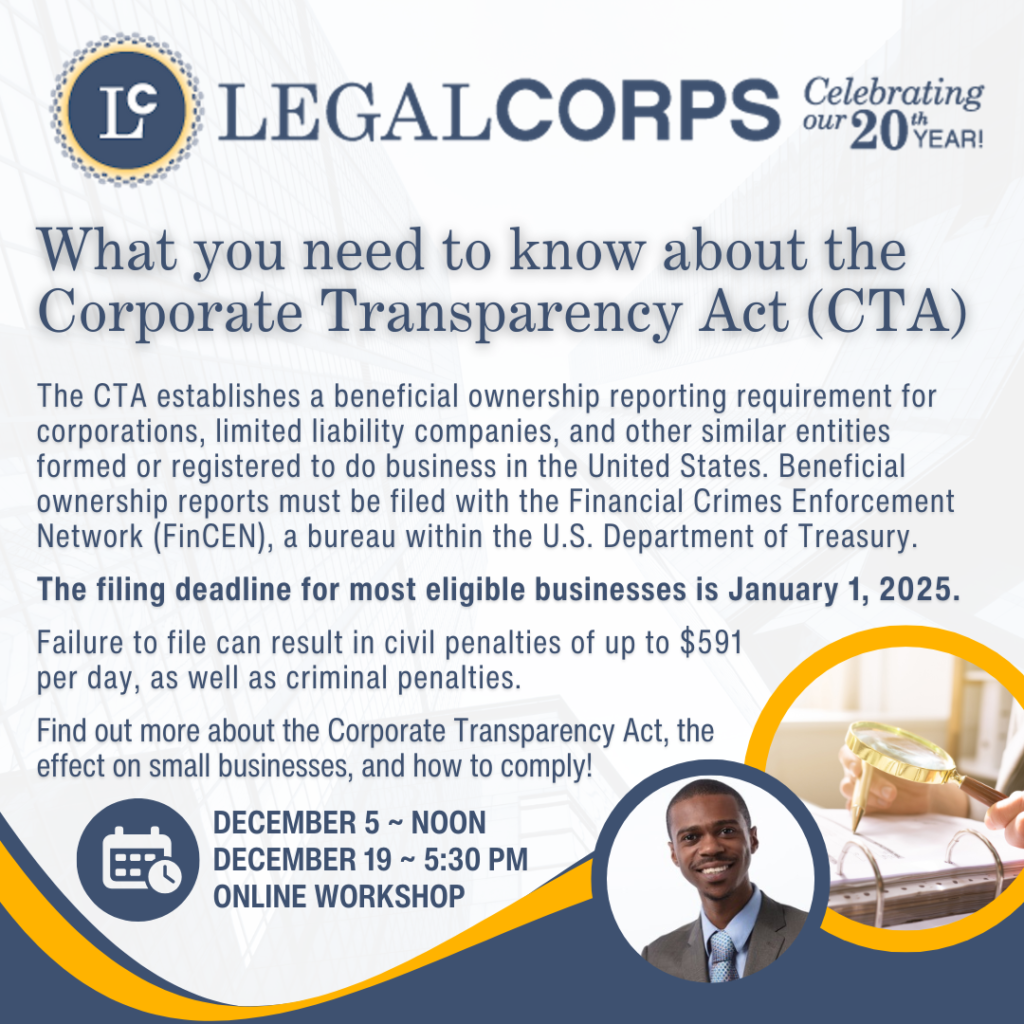

Join LegalCORPS Lead Staff Attorney, Joshua Franklin, for an online workshop about the Corporate Transparency Act (CTA). This online workshop will be offered on Thursday, December 5 at Noon and on Thursday, Decembrer 19 at 5:30 PM. Click HERE to register and learn about the CTA’s effect on small businesses and how to comply.

Once you have registered, we will send you details about accessing the online workshop.